Savings Goals Feature

Responsibilities

This UI freelance project involved assisting Rune's team in first developing Nivi, a data analytic tool designed to help larger companies reduce carbon emissions and comply with EU regulations before 2030. Following that, the Nivi tool required an informative website to drive new clients. With the team's extensive experience in driving sustainable targets at Mærsk, I contributed UI and web design expertise to ensure we delivered a long-term, user-friendly solution. It was a pleasant five months online collaboration.

• Conducting user research

• Preparing interviews and surveys

• Analysing research material

• Decision-making on user experience

• Identifying new opportunities for the spanish market

Problem

As Tom Newton mentioned "No one wants to save up, they want to enjoy what they’re saving up for”. The question was really: "How might we improve the Savings Goals feature, so that the Spaniards will set and achieve their savings goal?"

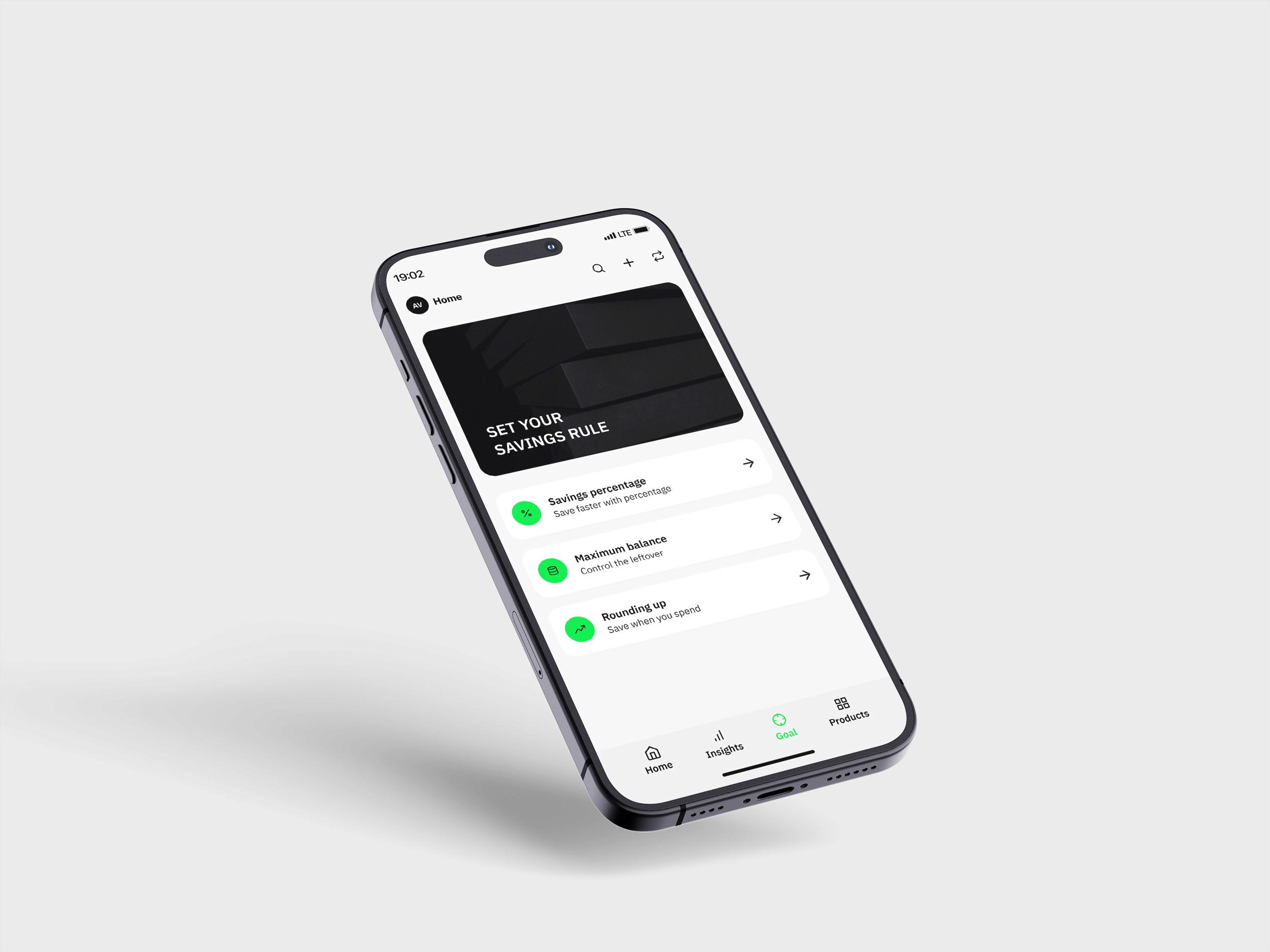

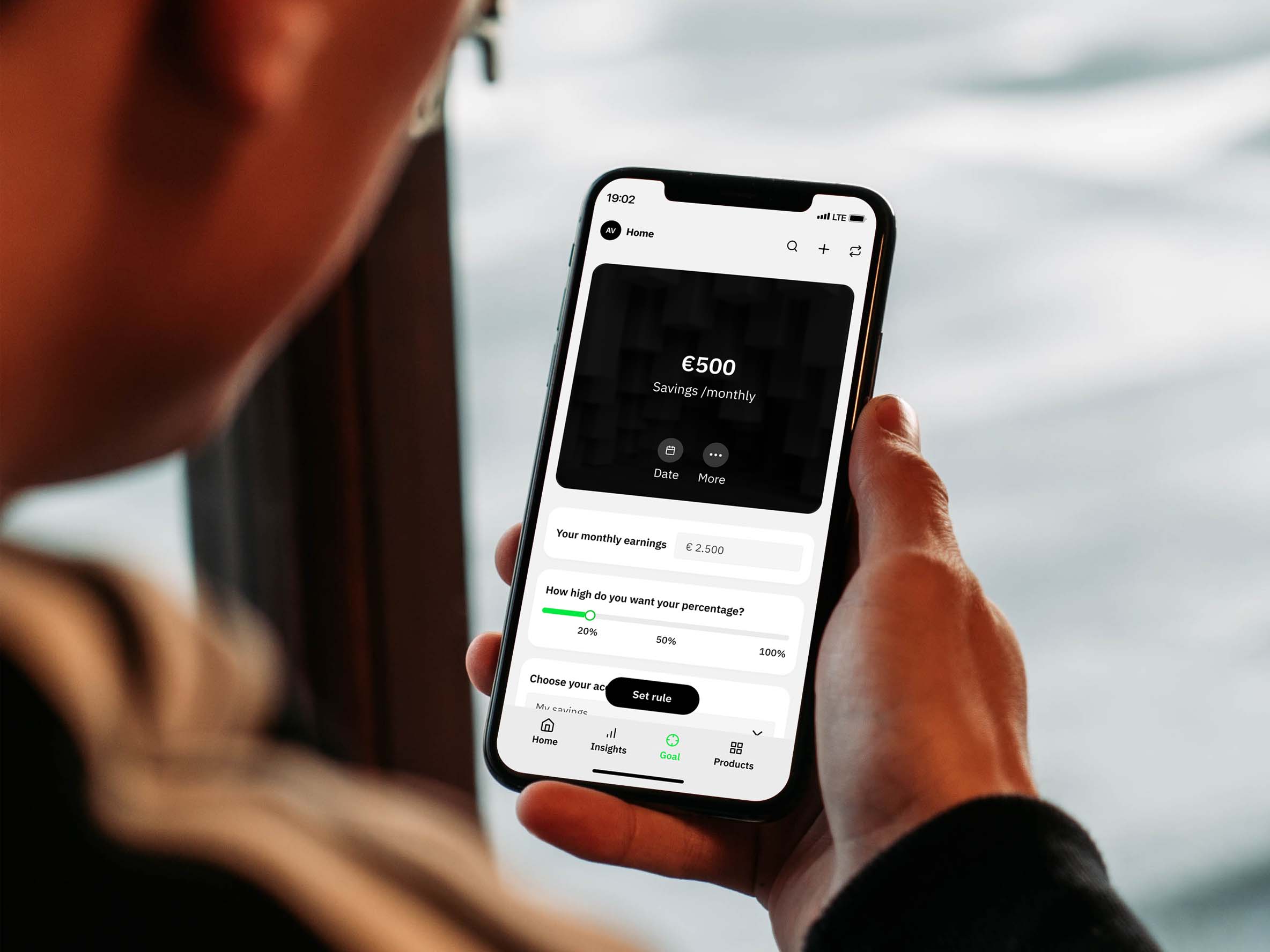

Solution

Taking the user needs of Spaniards and business mission into consideration the savings goal feature focused on main features that make it effortless to plan a savings goal and creating high-level of control, by setting automatic savings.

Framework

I’ve used the 5W1H framework Why, Who, What, When/Where & Howto create a structure that helped me to structure my thoughts, asking questions and making assumptions in the early-stage. In that way I could better define what the project was aiming for. Since I was a one-man UX/UI team, I got clarifications from Tom Newton on the business and audience aspects.

Research

Before digging into the user interviews I wanted to understand possible factors for Spaniards saving up behaviour, and from the desk research I made my first assumption: "The majority of Spaniards do save up, though their saving behaviour is a flexible and short term way of saving up, because they want to have a flexible lifestyle where they only store money in the bank for a short period of time."

I needed to get an understanding of the behaviour of Spaniards towards saving up their money, so I conducted five lance online user interviews with people living from anywhere in Cordoba, Barcelona and Bilbao. I asked them open questions such as:

• 1. Can you tell me about the last time you wanted to buy something and achieved it? • 2. Can you tell me about your last time you wanted to buy something and did not achieve and why not? • 3. How do you save up for something you want to buy in the nearest future (i.e. a vacation to France or a playstation)? • 4. What is stopping you from setting a saving goal? • 5. What would excite you and motivate you in order to achieve your saving goal? • 6. How do you keep track on your personal finances today?

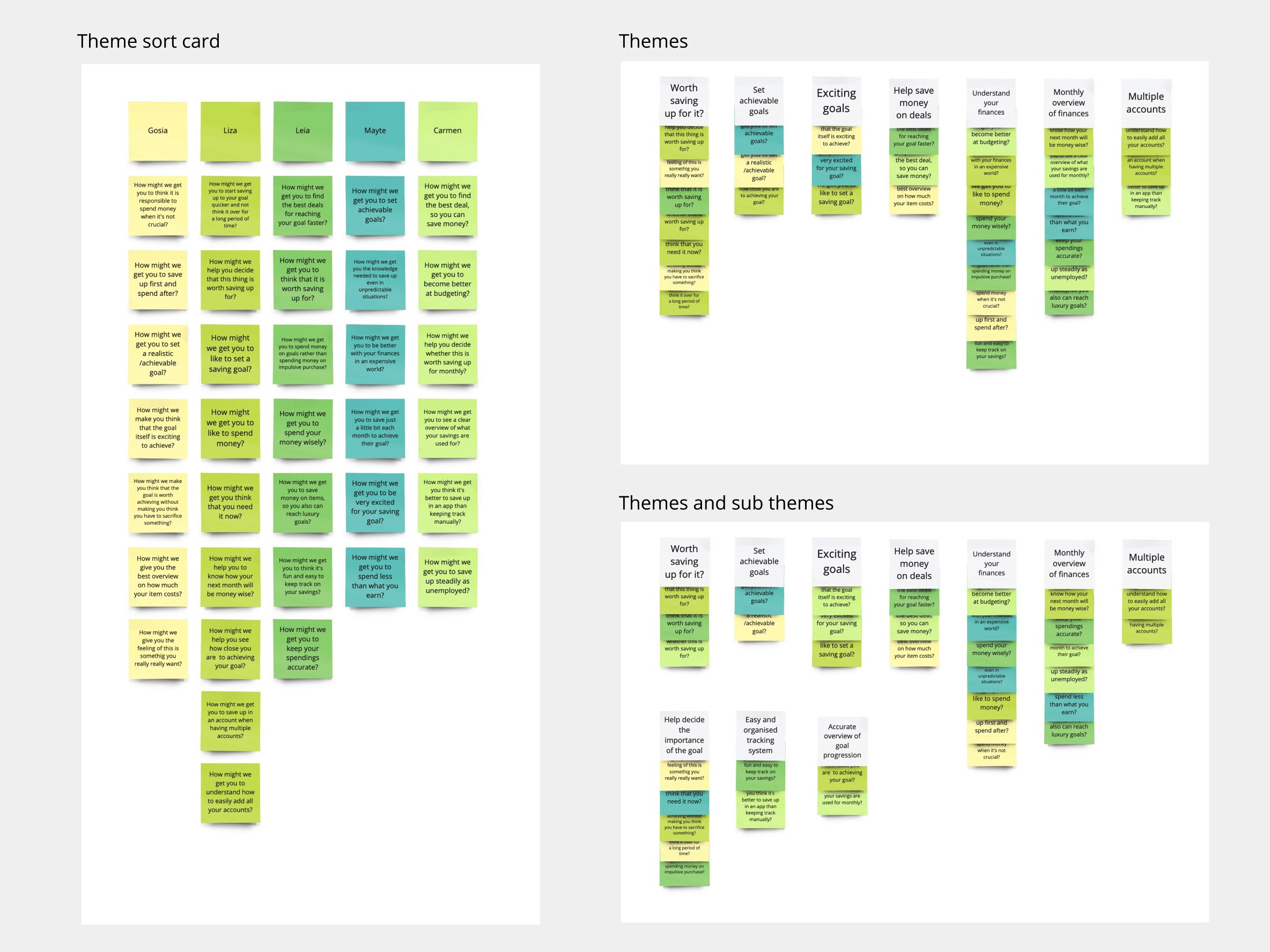

By allowing me to organise this large amount of data from the user interviews I used theme sorting. I was looking to capture the similar patterns from the interviewees so I started clustering similar information into themes. First I laid out all the information onto sticky notes, then I themed them and decided to diverge some of the themes into sub themes, ending up having 10 overall themes that I continued working with.

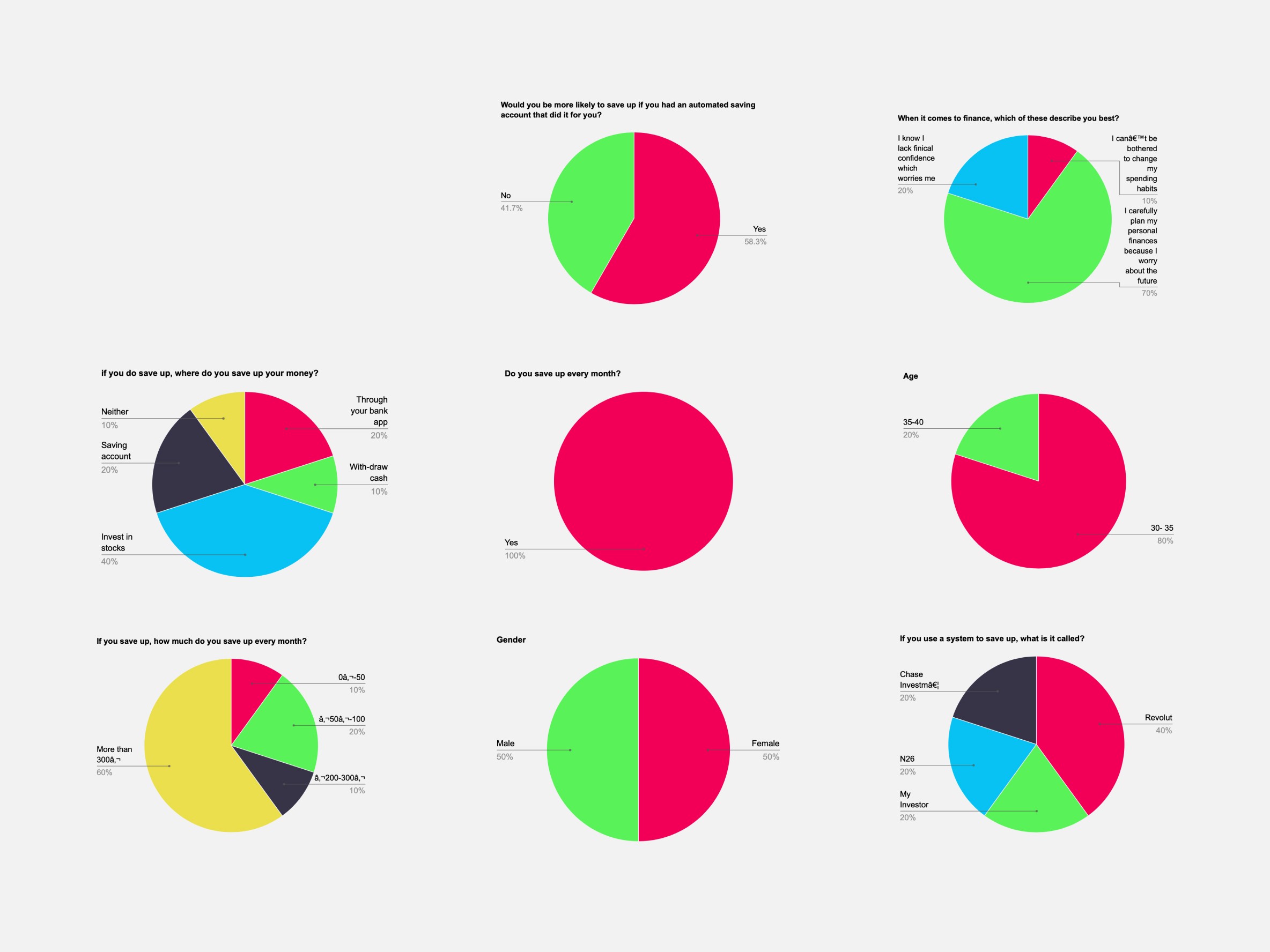

Besides doing user interviews I combined user surveys to get a more comprehensive understanding of my users living in Spain in shorter time. I managed to get eight responses that indeed helped me do a cross reference between the findings of the user interviews with the data from the online survey. The users revealed to be:

Both females and males, age between 30-35 years do save up more than 300€ monthly and are able to have high-amount goals. They majority save up in stocks and investments. They would be more likely to save up if, they have an automatic saving account. More over the interviewees carefully plan their personal finances, because they worry about the future. They use bank accounts and investment accounts such as, Revolut, My Investor, N26, Chase Investments.

They try to carefully plan out their budgetting even though it can be difficult due to not having an accurate saving system or unpredictable situations as shown in these user statements: "Good Budget… you just set a budget for different criteria, like in my case it's rent, food, personal care and entertainment…but it's not very nice, because if I forgot to put it in I know it's not 100% accurate, but it does give me an insight of what I have spend…" Normally when I don't achieve my goal is because something unforeseen happened that make me not be able to save money…"

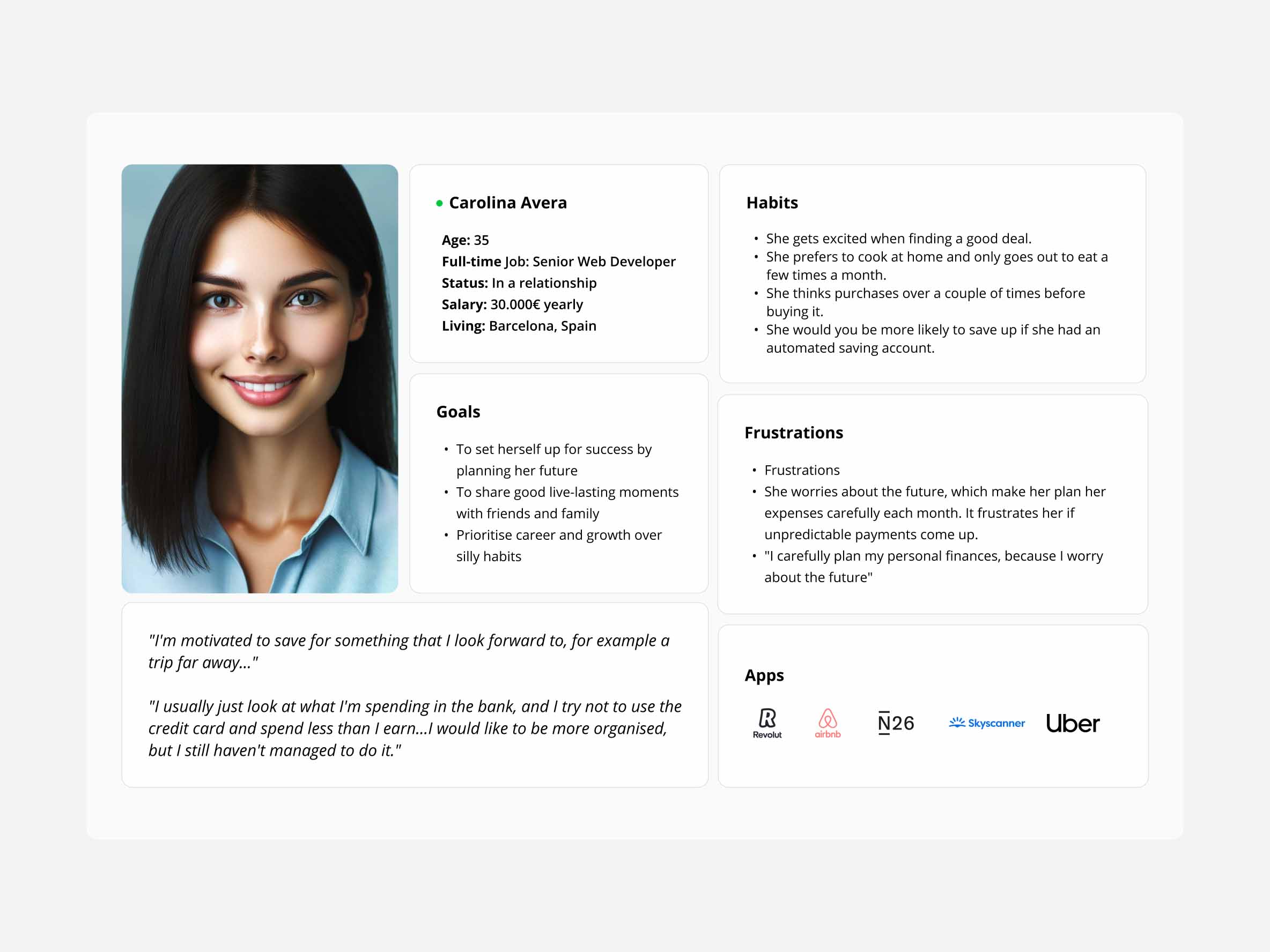

What I found in my user research was unexpected and the insights helped me pivot my understanding of the user behavior on the spanish market to this direction: The users have-long term plans for saving up, they save up a high amount each month and they rate categorise themselves as being the green archetype: "I carefully plan my personal finances, because I worry about the future". The green archetype is a specific persona that Lunar is working with and has been provided by Tom Newton.

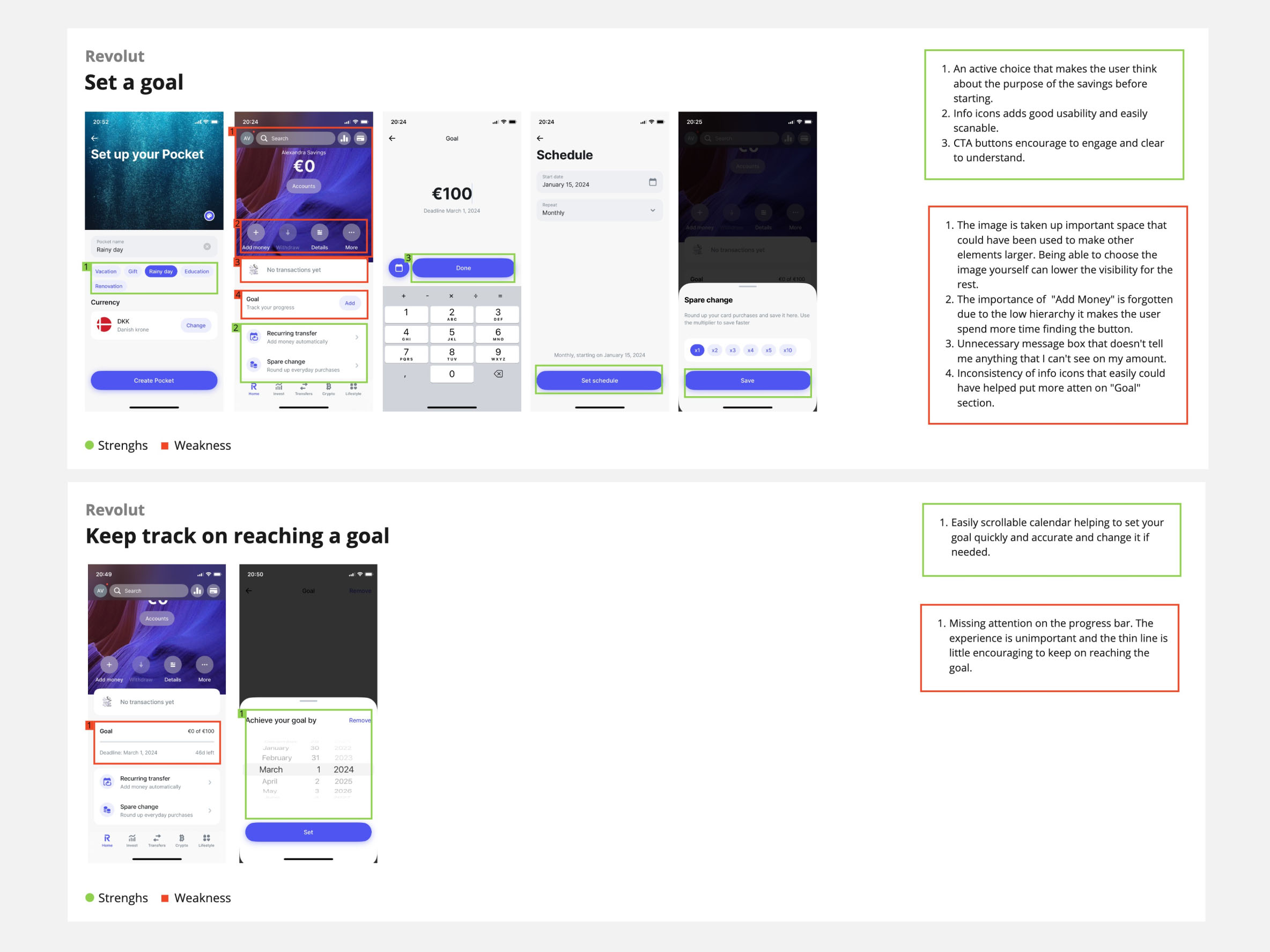

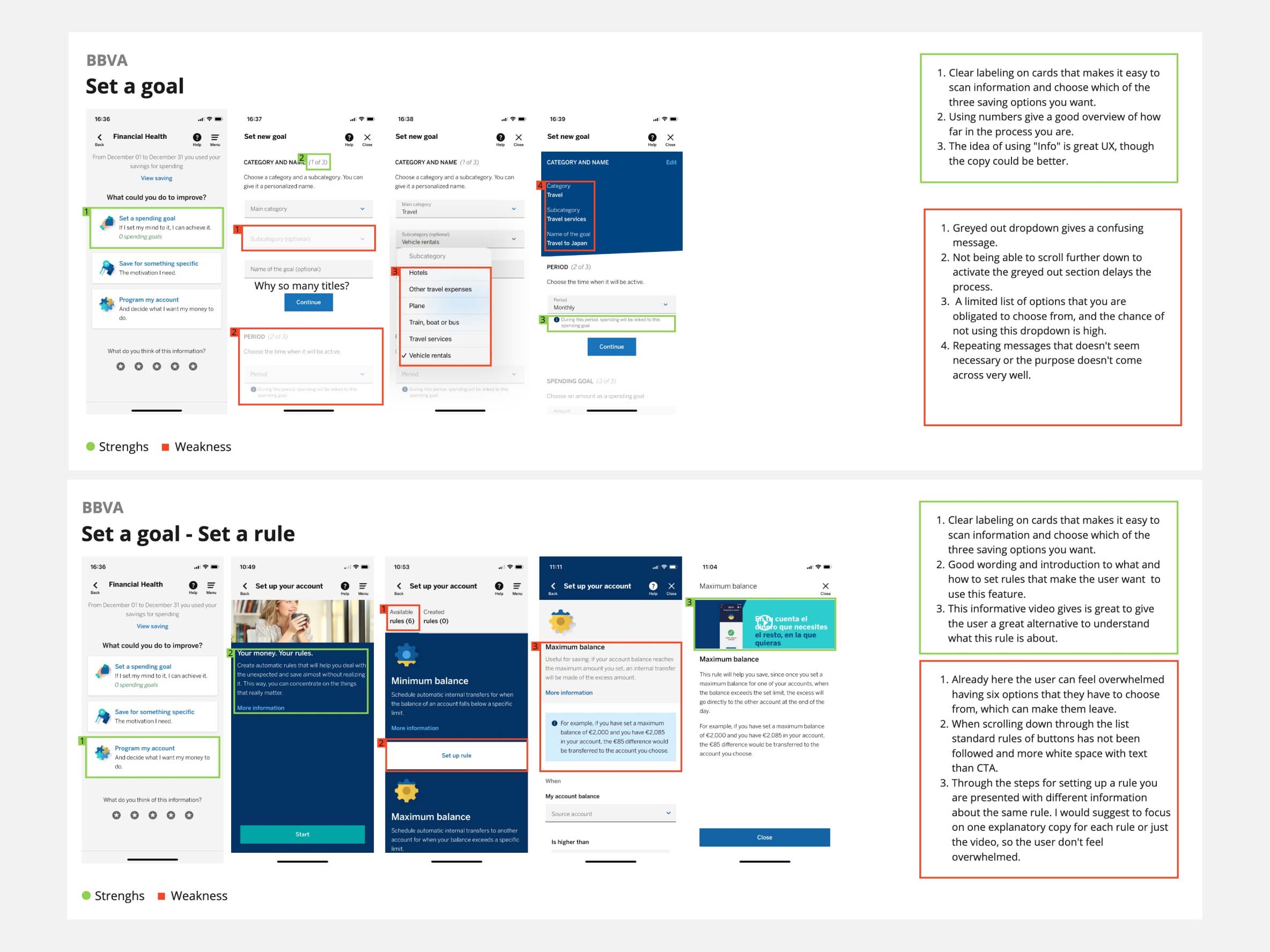

I focused on understanding how direct competitors such as Revolut, BBVA, My Investor and Good Budget were acting on the market- What was their strengths and weaknesses, including essential features creating their user experience. This analysis served as an inspiration for functionalities to avoid or implement into the solution. Some questions I wanted to know when starting the competitive analysis: Who is currently trying to solve this problem? How are they trying to solve the problem? What their main differentiator or unique value-add is for their product?

Define

So far in this process I have been converging and diverging the information, and now it's time to converge the information once again. Based on the insight I have got a good understanding of my users and what kind of problems they are facing, so let me present it here.

1. The problem is that they do not set and commit to a goal if they do not think it is worth saving up for and has to sacrifice something.

2. The problem is that they need to know it is an achievable goal, before they set and commit to saving up towards it.

3. The problem is that they need to feel excited about achieving the goal, before they set and commit to it.

4. The problem is that they are not motivated to use a saving app if it is not easy, accurate, meausure the progression and organise their savings.

5. The problem is that their lack of financial intelligence can hinder them to set and achieve saving goals.

6. The problem is that even small unpredictable payments can hinder them in achieving their saving goal.

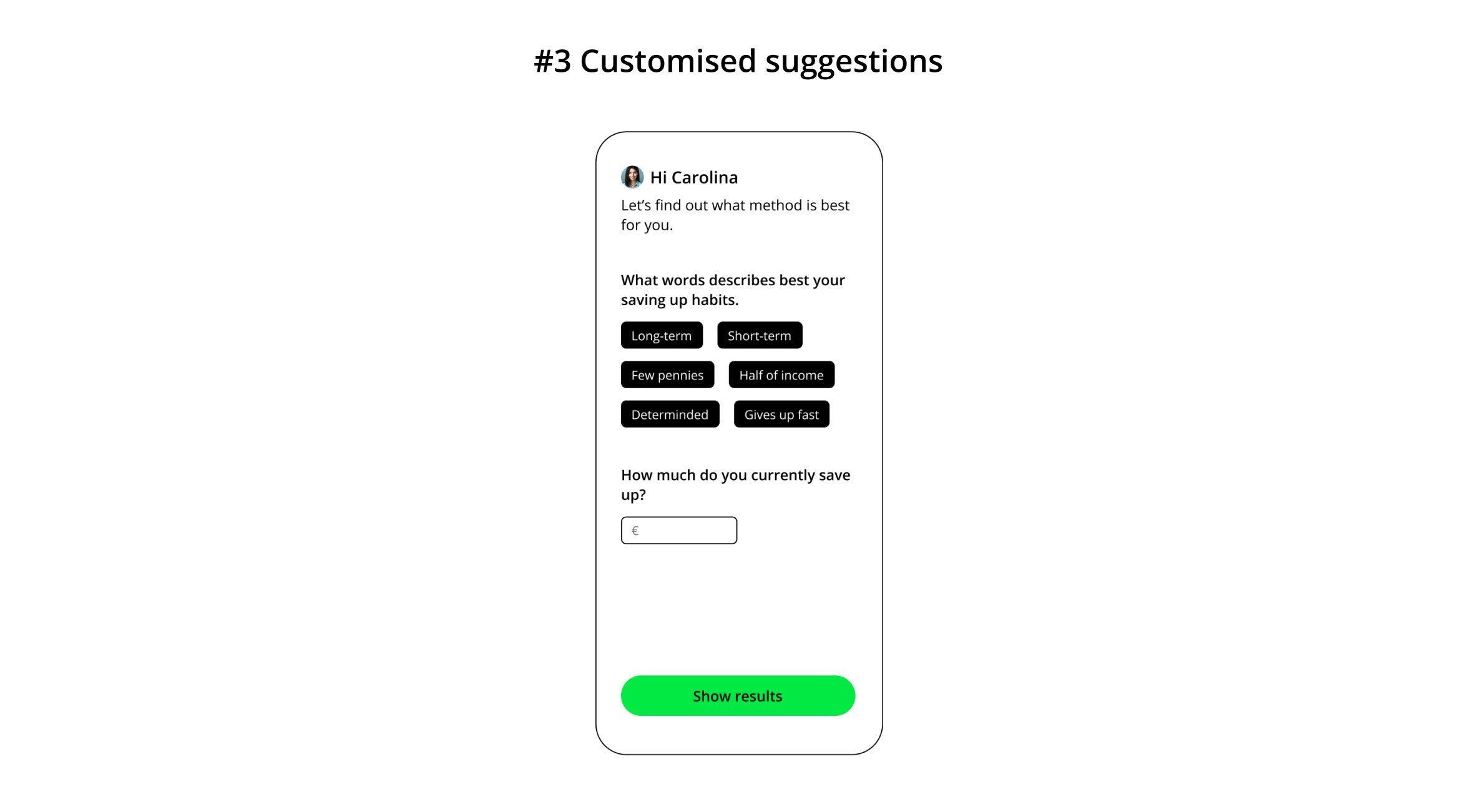

The persona who is going to help me guide the design choices is Carolina Avera. She is a representative user who is also based on Lunar's green archetype who ""I carefully plan my personal finances, because I worry about the future".

The user faces different problems towards reaching their Savings Goal, which I have turned into six guiding questions that be the base of the ideation phase.

1. How can I design a solution that will help them find out whether this goal is worth saving up for, so they don't feel they sacrifice something?

2. How can I design a solution that show how achievable this goal is to them?

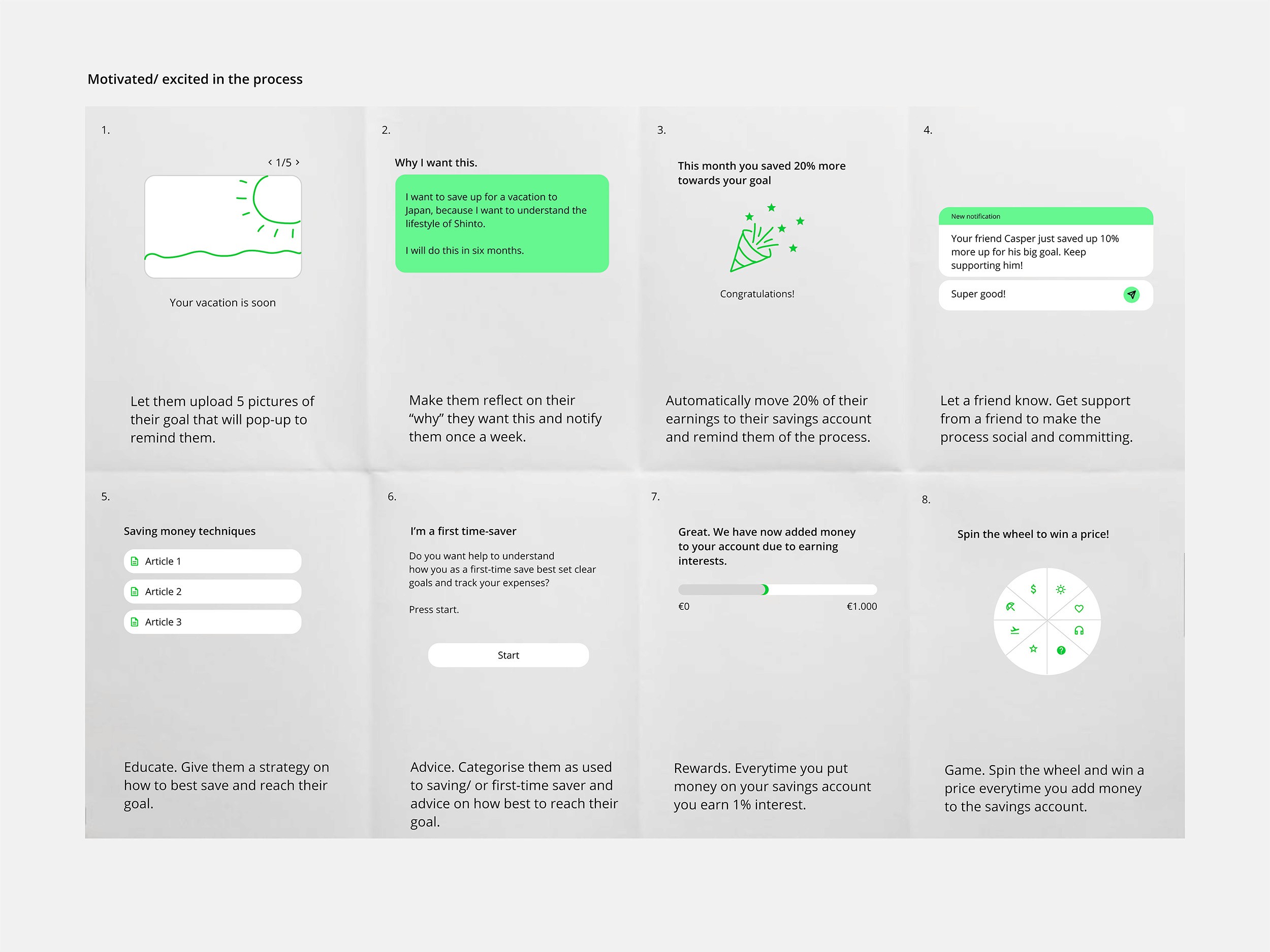

3. How can I design a solution that keeps them excited/motivated in the entire process towards achieving their goal?

4. How can I design a solution that is intuitive and accurate to use and can organise their savings?

5. How can I design a solution that can educate them about finances and set them up for success?

6. How can I design a solution that can make them aware of any unpredictable payments?

Ideation

Since I was solo-designer, I evaluated the iterations stages with Tom Newton as I generated ideas for how to solve the tasks as well as keeping the business mission of Lunar in mind.

I shaped the previous 48 ideas into a T-Bar format to better collect the ideas and explain the concepts and functions in details. Here are four final concepts that I afterwards evaluated in a validation matrix.

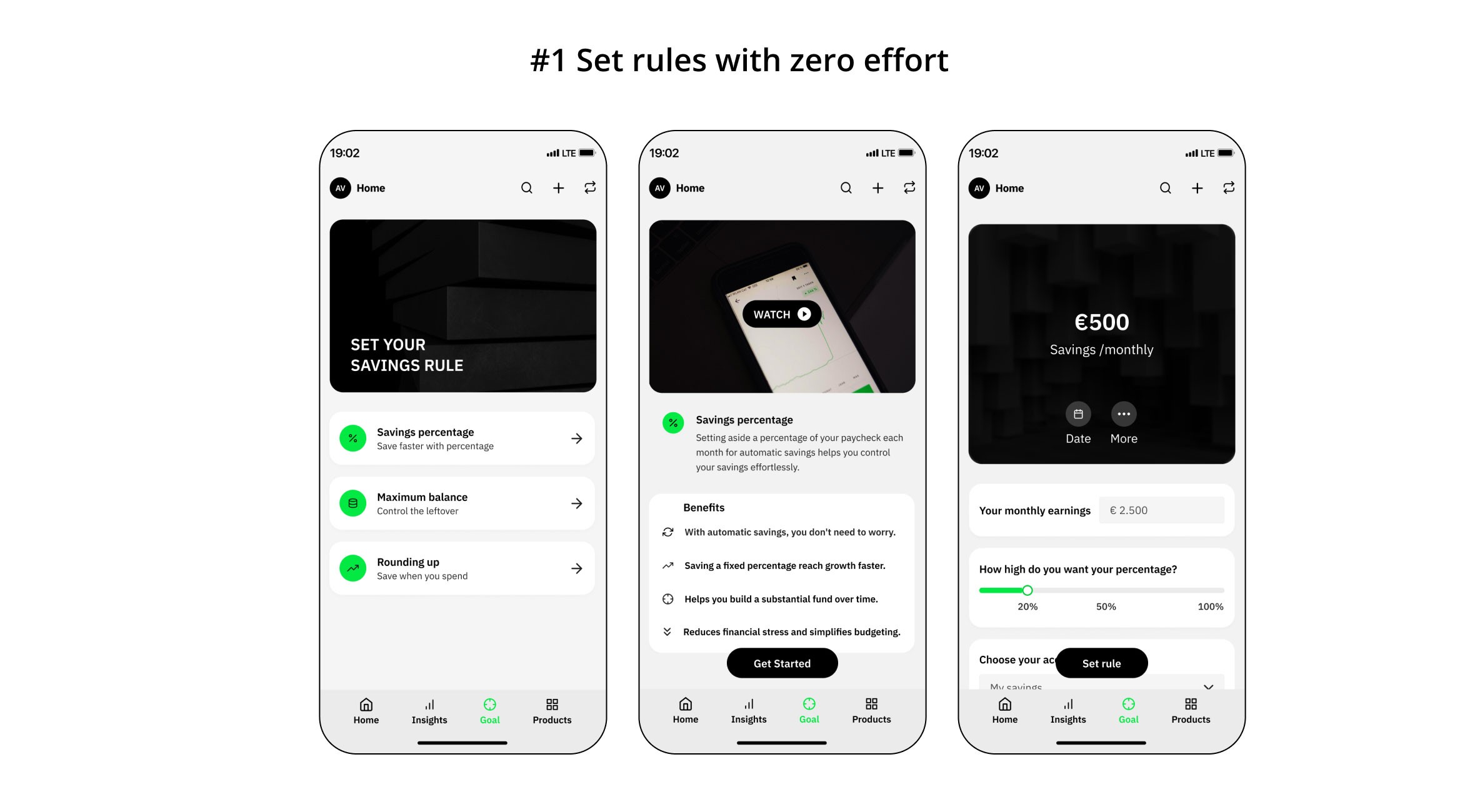

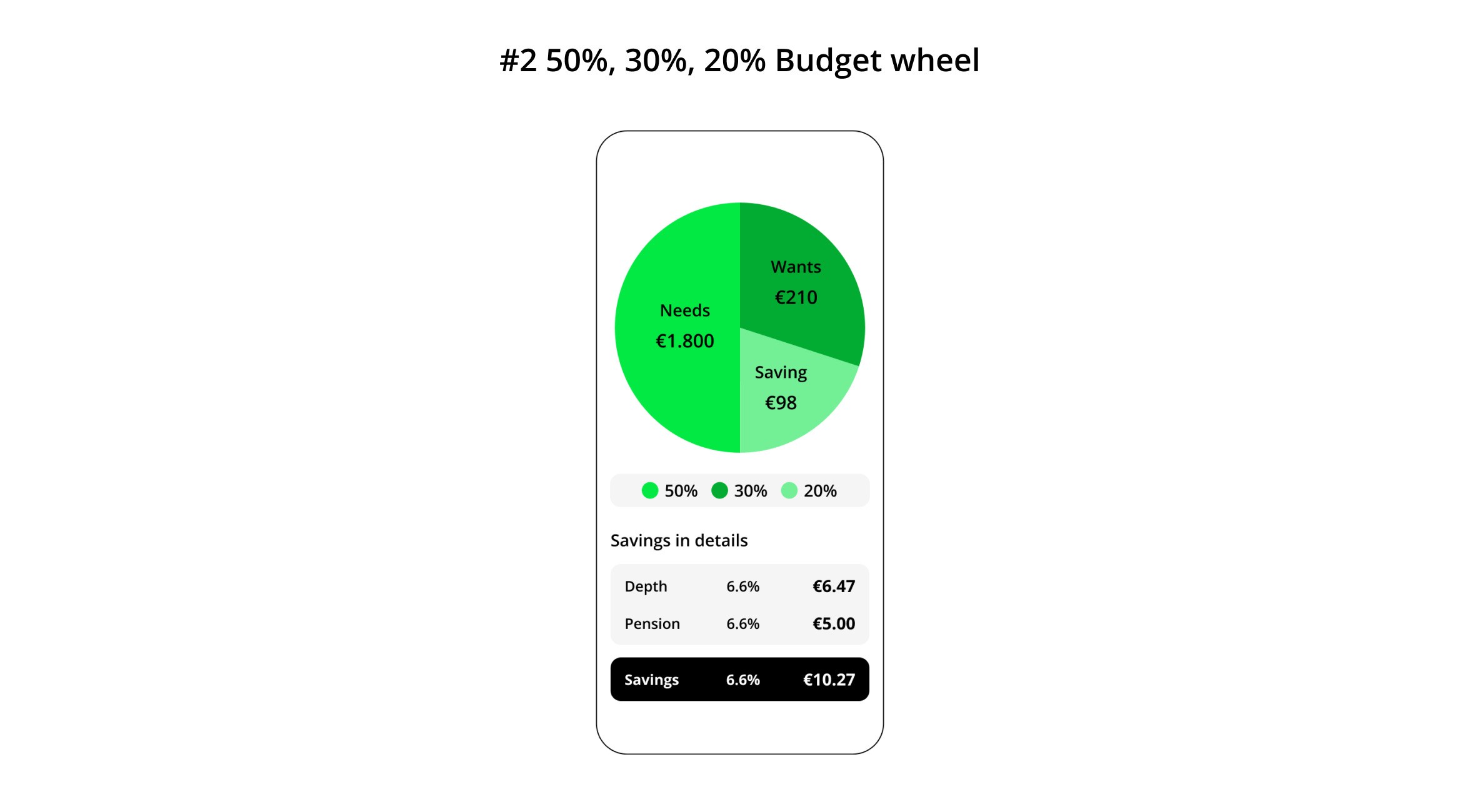

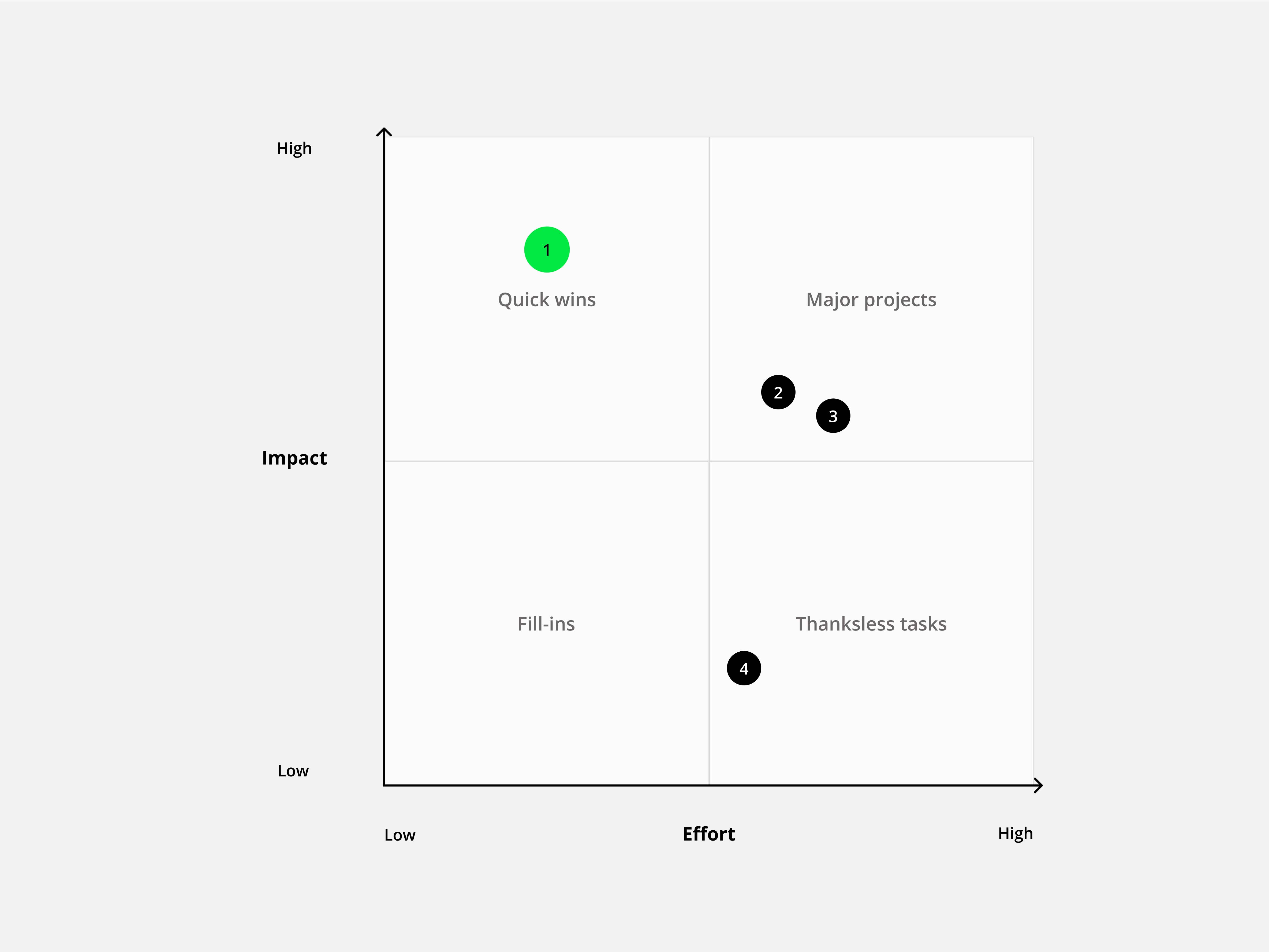

#1 Set rules with zero effort, #2 50%, 30%, 20% BUDGET WHEEL, #3 Customised suggestions, #4 Personal assistant

It was important to adhere to both the users needs but also to the business expectations from Lunar. I therefore based the prioritisation and evaluation of the concept on the best balance between the impact and business effort. Also I took into consideration that the solution should feel liberating and not limiting, so the user feel in control at all-times.

The winner is: #1 SET RULES WITH ZERO EFFORT: because it has the biggest impact even though the concept is not as competitive as the others. I will go with this idea since the solution still correlates to business mission, user needs and has several advantages to improve the existing "Savings Goals" experience: It minimises the worry of planning each month, improves the control level of your savings, and makes the savings more organised and can reduce drop-outs.

Next step: Prototype

This collaboration with Tom Newton was intense and instructive. I gained great insight on how Lunar’s bank app work and then Tom was a great guy to work with. Since the project was sat on pause I still have contact with Tom time to time. If the project would start up again the next step would be to build the prototype for concept #1. We had already decided to move on with performing a moderated test and an unmoderated test. It might be relevant in the nearest future.